https://en.wikipedia.org/wiki/Peter_Lynch

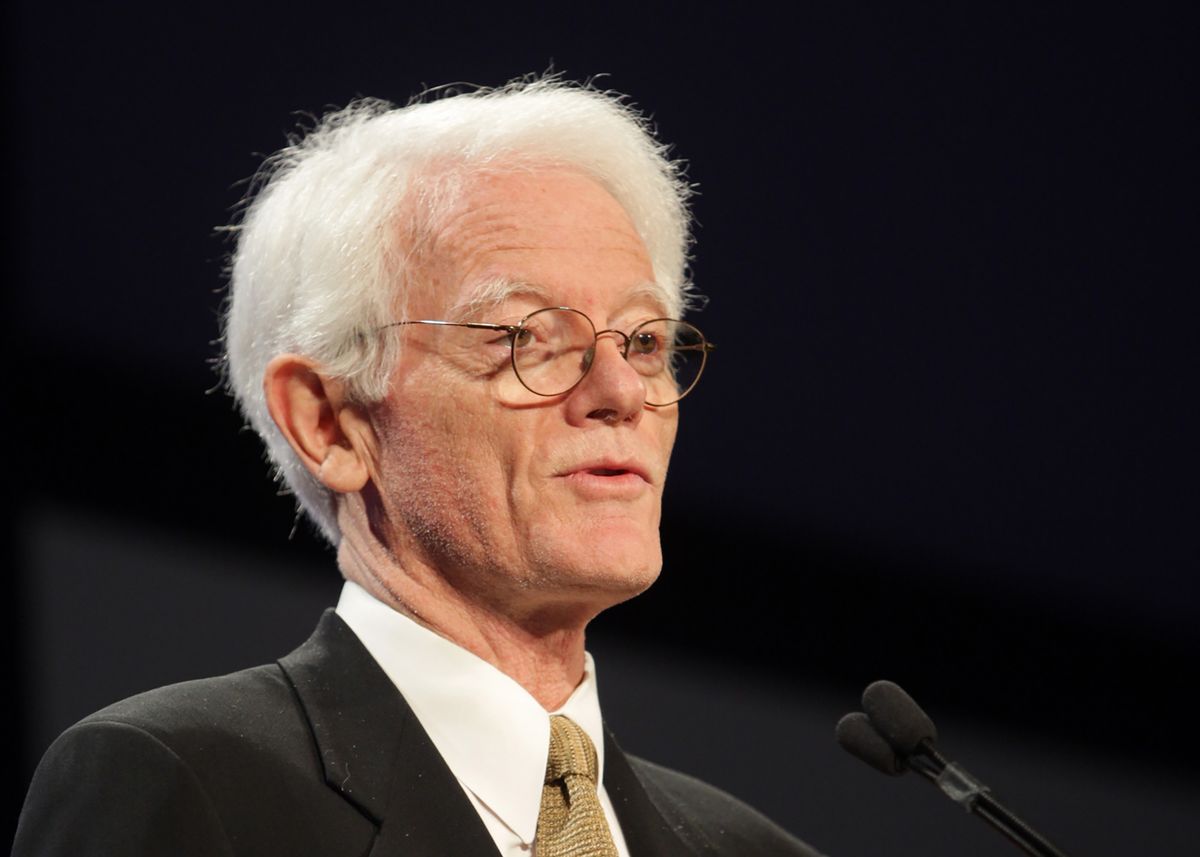

彼得·林奇 Peter Lynch, 富达投资副主席, 麦哲伦基金的13年间,年平均复利报酬率达29.2%。他的高回报成功要素:1 中长期投资;2 做研究分析

https://www.fidelity.com/viewpoints/investing-ideas/peter-lynch-investment-strategy

Video#3 “Navigating choppy markets” 关于做中长期投资者:

林奇: 过去10年,30年,100年股市是最好的投资处,尽管市场常有波动;但如果你未来1年,2年要用的钱,不应该投资股市,应该放在货币基金!

Video #5 “Why company research matters”:

林奇: 投资需要做大量研究,股市不是彩票。股票背后是它们的公司,如果公司运营的好,长期来说,这些股票也会涨的很好;反之亦然!怎么能做到投资成功呢?我们必须来研究分析这些公司,这就是Peter Lynch在富达的成功秘诀!

What's the biggest mistake you see individual investors making?

Lynch: The public's careful when they buy a house, when they buy a refrigerator, when they buy a car. They'll work hours to save a hundred dollars on a roundtrip air ticket. They'll put $5,000 or $10,000 on some zany idea they heard on the bus. That's gambling. That's not investing. That's not research. That's just total speculation.

彼得·林奇分享股票投資中最重要的一課 - 1994年珍貴演讲(完整字幕版)

January 09, 2023 - BY Admin

January 09, 2023 - BY Admin